May 22, 2024

Sanofi, Formation Bio, and OpenAI have announced a pioneering collaboration aimed at accelerating drug development using artificial intelligence (AI). This …

Jan. 12, 2024

Advances in computational biology, precision medicine, artificial intelligence/machine learning, etc., are launching us into a world where strategic control points …

Aug. 1, 2023

As the global pharmaceutical landscape continues to transform at a breathtaking pace, it becomes crucial to examine the phenomenon that …

Dec. 15, 2022

In oncology, we do the best we can. We give drugs with 10-20% chances of working because we have nothing …

Aug. 8, 2022

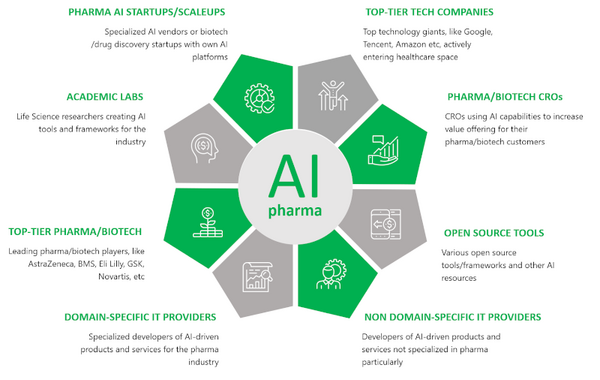

(This article was originally published in 2020 and updated in August 2022) Reading life science blogs is a good way …

July 6, 2022

It took more than eight decades since the landmark experiments on calorie restrictions in 1930th to get to a point …

May 24, 2021

The overall technological progress in medicine and the overall increase in the quality and safety of life, compared to even …

Jan. 15, 2021

A decade ago, iPSC (induced Pluripotent Stem Cell) technology was viewed as science fiction. iPSC can be obtained from adult …

Nov. 29, 2020

Table of Contents: Introduction The abundance of venture capital, major funding rounds New AI-driven biotech startups founded in 2020 Notable …

Feb. 21, 2020

Pharmaceutical manufacturers find themselves at a critical juncture. In the past 30 years, pharma has seen some significant shifts. Consider …

Jan. 28, 2020

Computer-aided drug design (CADD) is a central part of so-called “rational drug design”, pioneered in the last century by companies …

Jan. 2, 2020

There is a plethora of analytics reports, including ones by Deloitte, DKV Global, and Ernst and Young, all pointing out …

![[Interview] The Rise of Quantum Physics …](/files/blog/20190715_222113.7097_Enric_Pharmacelera.png)