Hunting Cancer Before It Can Hunt You: A Bird's Eye View of Cell-Free DNA Market Trends

Chapter 2 of a Hitchhiker's Guide to Cell-Free DNA.

By the end of 2022, there will be an estimated 609,360 deaths cause by cancer in the US alone [1]. In 2018 there were 17 million new cancer cases and 9.5 million cancer deaths worldwide [2]. By 2040, this is expected to increase to 27.5 million new cancer cases and 16.3 million cancer deaths annually [2]. Currently, only five cancer screening tests are available in the US (breast, colorectal, cervical, lung and prostate), accounting for 42% of annual cancer incidence in people aged 50-90 [3]. Cancer detection before stage IV could reduce cancer-related deaths by >15% within 5 years [3]. Accordingly, the population health cell-free DNA (cfDNA) industry is expected to grow to nearly 30 billion dollars by 2028 [4]. Unsurprisingly, cfDNA will pervade every facet of clinical care, drug development, clinical trials, etc. This has not been lost on the business world as a market that barely existed a little over a decade ago is becoming increasingly saturated. Indeed, there is a new start-up in the cfDNA space daily. The reason for this isn’t just financial, it’s also related to the simplicity of these methodologies and the accessibility of artificial intelligence and machine learning. In the last edition of this series, “The Hitchhiker’s Guide to Cell-Free DNA, Chapter One”, you were introduced as CEO of the fictitious company, Comprehensive Precision. You presented an extensive cfDNA and liquid biopsy primer to your board, and now have to prove your worth. Today you must present your plan to enter the cfDNA market comprised of very talented companies, including Grail, Exact Sciences, Freenome, Guardant Health, etc. Your focus is on population health screening as you intend to put oncologists like me out of a job by identifying cancer before it’s apparent radiographically or symptomatically. Today, in Chapter 2 of “The Hitchhiker’s Guide to Cell-Free DNA” we will perform a cursory market analysis and targeted description of population health cancer screening companies, discuss the associated value chain, and explore methods of entry into the market.

Cursory Market Analysis

Knowing there are numerous ways to evaluate an industry, you begin your assessment of the population health cancer screening cfDNA market with a Porter’s Five Forces Analysis (figure 1).

Figure 1: Porter’s Five Forces for cfDNA based cancer screening

You note that the potential for new entrants, buyer power, threat of substitution, and competitive rivalry forces are HIGH. Even the power of suppliers is MODERATE to HIGH. Accordingly, you conclude the cancer screening cfDNA industry is hostile. You feel companies thinking of entering the field should NOT do so UNLESS they have a disruptive technology or are well established liquid biopsy entities (e.g., Tempus, Caris, Neogenomics, etc.). By the time your company, Comprehensive Precision, could develop a cfDNA population health platform there may be no more worlds left to conquer. Indeed, the brilliant approach the competition has taken is to partner with academic institutions, community networks, insurance companies, etc., to prohibit new entrants from entering the market.

Grail, maker of the Galleri test, aggressively developed partnerships with numerous institutions, including the Cleveland Clinic, Dara-Farber Cancer Institute, Intermountain Healthcare, Mayo Clinic, Sarah Cannon, Sutter Health, US Oncology Network, Allegany Health System, Ohio State, Vanderbilt, Munich Re Life US (life insurance), etc. They have a contract with the UK NHS to perform 140,000 of the Galleri cancer screening test, and an agreement with the US Department of Veterans Affairs for 10,000.

Freenome, who makes a test for early detection of colorectal cancer, partnered with Biognosys, Brigham and Women’s Hospital, institutCurie, Qiagen, UC SanDiego Health System, UCSF, and the Parker Institute for Cancer Immunotherapy. Moreover, Roche has 360 million dollars invested in Freenome.

Thrive Earlier Detection, maker of the CancerSEEK screening test, and who Exact Sciences purchased for 2.15 billion dollars, have partnerships with Pfizer, Mission Wisconsin, etc., but seem to be lagging behind Freenome and Grail in this regard.

Guardant Health partnered with Epic EHR, containing over 250 million patients, to allow clinicians to order their Guardant Shield test. However, they also are lagging behind their competitors in identifying partners for their population health tests.

Natera, maker of Signatera cfDNA tests for colorectal cancer, bladder cancer, and immunotherapy response prediction, is an in-network provider with Aetna, Anthem, Cigna, and UHC. Additionally, they partnered with Foundation Medicine, Qiagen, etc.

Interestingly, Tempus, Caris, Neogenomics, etc. don’t appear to presently offer population health screening tests, which feels like a missed opportunity as it’s directly linked to their core competencies. Indeed, these are the only companies you envision competing with those aforementioned, without developing a disruptive technology. Even then you note it would be difficult.

Ultimately, solely based on your Porter’s Five Forces analysis and assessment of how competitors are positioned, you conclude Comprehensive Precision should not enter the cfDNA population health cancer screening market without a disruptive technology. Accordingly, you forego performing market segmentation, conjoint analysis, pricing strategy, etc., as it wouldn’t change your view at this time. However, you do consider the possibility of entering the market with a disruptive approach and technology. You begin by assessing your competitors.

Grail and their Galleri test

Illumina announced their acquisition of Grail for 8 billion dollars August 18, 2021. This was fascinating on multiple levels. Initially, Illumina actually formed Grail and spun it out in 2016. Grail’s first employees were part of Illumina, which still owned 12% of Grail at the time of the acquisition. By that time Grail had already raised $1.9 billion from investors, including Jeff Bezos and Bill Gates [5]. Moreover, the Illumina-Grail platform allowed for a profound level of vertical integration rarely seen in the genomics industry. This prompted the Federal Trade Commission (FTC) and European Commission to investigate the deal. The FTC filed an administrative complaint and authorized a federal court lawsuit to block Illumina’s proposed acquisition of Grail [6, 7]; the case is ongoing. Nonetheless, Illumina, in moves that are long overdue, is leveraging its genomics expertise to vertically integrate in ways it didn’t previously. Most notably, Illumina is aggressively entering the drug target identification and drug development forums [8]; a move you feel other precision genomics companies should emulate if they are not already.

Grail’s population health cancer screening test is called Galleri. Grail claims the Galleri test can adequately detect if a patient has one of 50 different cancers from a single vial of blood [9]. It is presently available to patients by prescription. To date, Galleri has been prescribed by more than 2,400 prescribing partners and has 34 partnerships with health systems, employers, and insurers. Most surprisingly, this includes the life insurance company, Munich Re Life US, which has raised many red flags.

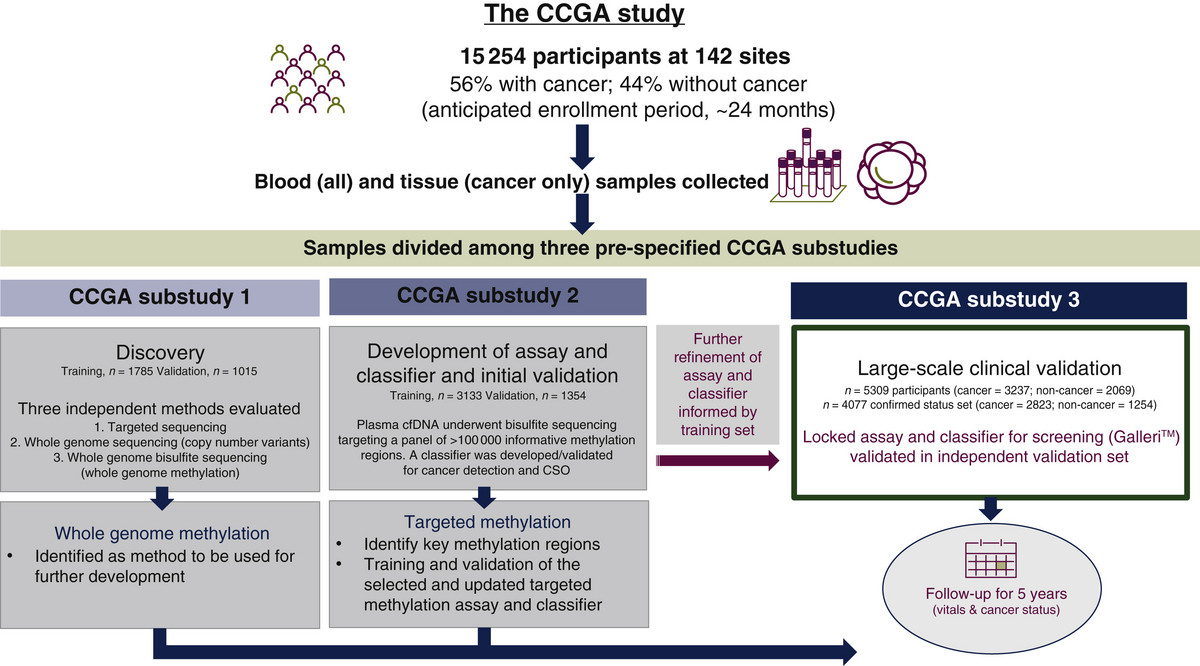

In their seminal CCGA study, published in Annals of Oncology in 2021, Grail assessed 15,254 patients at 142 sites using their Galleri test (figure 2).

Figure 2: Design of Grail’s seminal CCGA study assessing their Galleri test

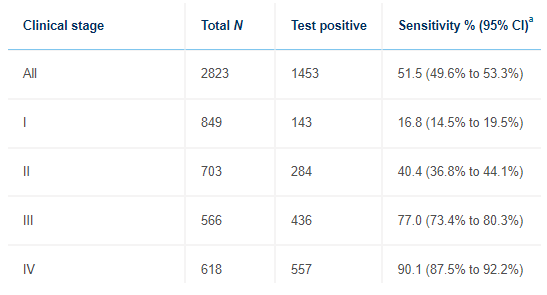

The Galleri test had an overall sensitivity of 51.5%, which basically means they detected cancer in 51.5% of patients who actually had cancer. It had a specificity of 99.5%, meaning the test reported no cancer in 99.5% of patients who didn’t have cancer. En face, this is fairly decent. However, it’s essential to note the sensitivity for stage 1 disease was only 16.8% (figure 3), and the patient population studied (56% positive for cancer) isn’t remotely representative of the general population that has a relatively low incidence of cancer.

Figure 3: Sensitivity of Galleri for cancer detection by stage

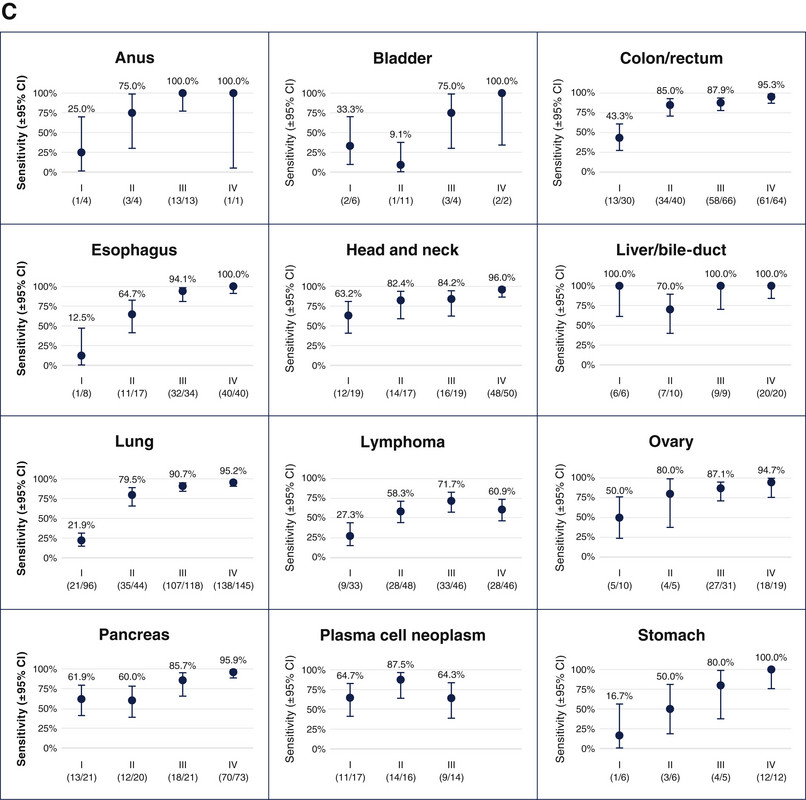

Grail is quick to point out Galleri detects 40% of the twelve “most deadly” cancers, including anal, bladder, colorectal, esophageal, head and neck, liver/bile-duct, lung, lymphoma, ovary, pancreatic, plasma-cell neoplasm and stomach cancer, while they are stage 1. These cancers account for approximately 2/3 of all cancer deaths in the US, and only one of them (lung) is routinely screened for. We do perform annual imaging and AFP tumor marker assessments on patients with cirrhosis, who are at high risk for hepatocellular carcinoma. Some physicians screen for pancreatic cancer in high-risk patients (e.g., BRCA mutated) with annual imaging and CA 19-9 cancer marker assessments. Similarly, patients at high risk for ovarian cancer (e.g., BRCA mutated), who don’t want a prophylactic bilateral oophorectomy may have annual imaging and CA 125 blood tests. Patients at high risk for gastric cancer (e.g., Lynch syndrome) are often subjected to periodic EGDs. Patients at high risk for bladder cancer (e.g., Lynch syndrome) often undergo annual urinalysis to assess for hematuria. Regardless, these tests are not routinely performed in the general population, who certainly develop these cancers. In addition, the aforementioned screening tests for high-risk patients are largely suboptimal. Thus, Grail has a legitimate argument that their ability to screen for these cancers, even at a 40% sensitivity for stage 1 disease, is an improvement over a status quo that doesn’t screen for them at all. Even more compelling is Grail’s argument their sensitivity is much higher when patients have higher stage disease, which can often go undetected due to a lack of symptoms (figure 4).

Figure 4: Grail’s Galleri performance in the 12 most deadly US cancer by stage

A thorough review of Grail’s data for the aforementioned 12 malignancies, illustrates Galleri’s tremendous potential for detecting stage 1 pancreatic, plasma cell, hepatobiliary, and head and neck cancers. However, the test performed relatively poorly for stage 1 gastric, lung, lymphoma, anus, esophageal, and bladder cancers. It performed much better across the board in advanced stages because there is more cell tumor DNA in the blood. Importantly, Galleri had a 0.5% false positive rate in this setting, compared to approximately 10-40% for traditional screening tests.

Ultimately, the data presented here was a very nice start for Grail. It enabled them to partner with UK NHS (figure 5) and the Veterans Administration to prospectively test 140,000 and 10,000 patients, respectively. The UK study is nearly filled, but could scale to 1 million, or even nationally, soon.

Figure 5: Grail is testing 140,000 patients with Galleri, in conjunction with the UK NHS

One critical thing to note, as I pointed out in Chapter 1 of this series, is the partnerships Grail established allow the company to tap into an extraordinary number of patients to not only test their Galleri assay and associated computational model, but to improve upon it. In fact, this might be the only example of a situation where a product can be optimized while it’s in clinical trials. Even if the test doesn’t work ideally, the data Grail will accumulate during testing will enable the company to make it better (see Chapter 1 of this series for further discussion). Thus, in a world where data is paramount to testing and improving a product, Grail has built a seemingly insurmountable lead. Indeed, just like anything in business, it’s much easier to capture new business than to steal it from a competitor, and Grail has planted itself firmly within the walls of numerous institutions.

Freenome

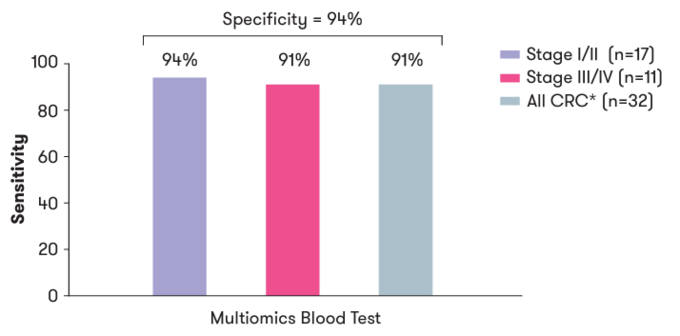

Freenome’s predominant offering is their colorectal cancer (CRC) early detection test. On their website they cite a study where they applied their test to 43 patients with colorectal cancer and 548 patients that were confirmed NOT to have cancer by colonoscopy [10]. They used whole-genome sequencing, bisulfite sequencing, and protein quantification methods in their test (see Chapter 1 for full description). They reported a sensitivity of 94% for stage 1/II colorectal cancer with an n of only 17 and 91% for stage III/IV colorectal cancer with an n of 11; specificity was 94% (figure 6).

Figure 6: Sensitivity and specificity of Freenome’s colorectal screening blood test by stage

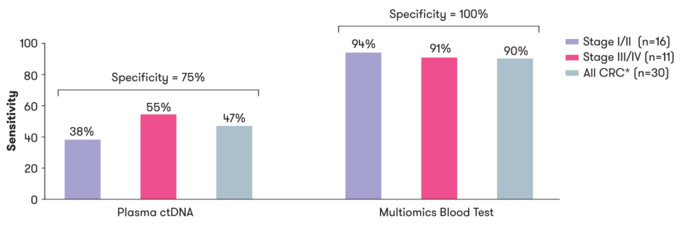

In addition, Freenome contends that incorporating protein assessment in their tests, as opposed to just relying on DNA and RNA, greatly increased sensitivity for colorectal cancer detection (figure 7).

Figure 7: Multiomics greatly increased the sensitivity of Freenome’s colorectal screening test over ctDNA assessment alone

In a separate study Freenome achieved an AUC of .92 with mean sensitivity of 85% and specificity of 85% for detecting stage I/II colorectal cancer (n=546 colorectal cancer and 271 non-cancer controls).

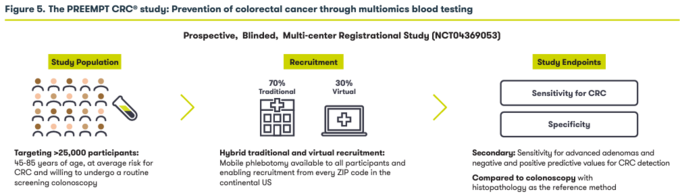

Freenome just completed enrollment for their prospective PREEMPT CRC study of 35,000 patients that will determine the ability of their test to properly identify healthy patients that develop colon cancer while enrolled in the study.

Figure 8: Illustration of Freenome’s PREEMPT colorectal cancer study

It will be very interesting to see the results of this study. Based on the aforementioned data from previous studies, it’s highly conceivable Freenome’s test is better than Galleri at detecting early-stage colorectal cancer, but time will tell.

Although Freenome’s focus is colorectal cancer, they are working on a direct competitor to Galleri for multi-cancer detection. However, the Freenome website leaves much to be desired, including making it easy to locate information pertaining to this.

Exact Sciences

Exact Sciences presently offers the Oncoguard Liver test with 82% sensitivity for early-stage hepatocellular carcinoma (compared to 40% for AFP blood testing), and 94% sensitivity for late-stage hepatocellular carcinoma [12]. They are developing a MCED (Multi-Cancer Early Detection) test that was studied in 10,006 women 65-75 years of age. 96 cancers were detected total, but only 26 of them were first detected by the MCED. The specificity of the test was 98.9%, and positive-predictive value 19.4%. It detected 14/45 cancers in seven organs where there was no screening test. Ultimately, this data was somewhat underwhelming as sensitivity for MCED cancer detection was 27%. Nonetheless, Exact Sciences is currently conducting additional tests with their MCED, which en face seems inferior to Galleri, although a tumor specific comparison of the two tests is beyond the scope of this discussion. Indeed, Exact Sciences spent 2.15 billion dollars to acquire Thread Live Science, so one must hope there is far better in store from their MCED test. It’s hard to envision there isn’t as Exact Sciences is a very good company.

Guardant Health

Guardant Health offers their Shield test for colorectal cancer screening [14]. Their ECLIPSE clinical trial evaluating the test is currently underway. This is a prospective trial enrolling 20,000 patients that is nearly identical to Freenome’s PREEMPT CRC study that just completed enrollment of 35,000 patients. Guardant Health should have real concerns here. If Freenome has a reasonable result they will likely be able to submit their test for FDA approval well before Guardant Health and be first to market.

Standing in Front of the Board

Ultimately, as CEO you conclude there is legitimacy to early detection of cancer using cfDNA. It is obvious Grail is light years ahead of everyone in the field. They are already being used by 2,400 subscribers, and you start to wonder if you should get a Galleri test annually. You make an appointment with your general physician to get the test, and ponder what to tell your board about entering the population health liquid biopsy market. You begin by saying:

The question of using liquid biopsy in early detection of cancer is not a question of “if we will?”, but “when we will?”. In fact, I contend we are already there. Grail’s Galleri test is being used by over 2,400 subscribers, and is currently being tested by the Veteran’s administration and the UK NHS. Grail has entrenched themselves in the population health cancer screening forum by partnering with numerous institutions, insurance companies, etc. They have insurmountable quantities of data to refine the algorithms underlying Galleri. They price their test at $949 and will likely seek FDA approval in 2023, pending the UK NHS study.

The Galleri test has significant deficiencies in the detection of stage 1 malignancies with an overall sensitivity of 16%, but you feel that will be overlooked by the FDA as Grail is providing an alternative to a suboptimal status quo where only five cancers are screened for. Importantly, Grail is not alone in this industry. I expect Freenome to make a compelling argument for approval of their test for colorectal cancer detection, but they are far behind in multicancer detection. Similarly, Exact Sciences has a very compelling argument for their hepatocellular early detection test, but their MCED (multicancer early detection) test has much to prove before it can compete with Galleri. Guardant Health, a very strong company with tremendous liquid biopsy expertise, appears to be in trouble with their colorectal cancer screening test as Freenome is ahead of them.

There are numerous other players in the population health cancer screening space, including Natera and Delfi, and the space is becoming rapidly saturated. Accordingly, my strong recommendation would be to avoid the population health cancer screening space altogether as we don’t have the core competencies of Tempus, Caris, Cegat, Neogenomics, etc., who could conceivably enter the forum at significant risk. The only caveat to this would be if we could develop disruptive technology that enabled us to capture strategic control points in the industry.

At this point you open a Powerpoint presentation you prepared titled, “Remedial Value Chain Analysis”.

Remedial Value Chain Analysis

Ultimately, who wins in the liquid biopsy population cancer screening market should come down to two primary issues.

- How well do they identify patients with cancer as having cancer (sensitivity), and how well do they identify them as not having cancer when they don’t have cancer (specificity)?

- What is the cost-benefit ratio of their test?

Of course, there is far more to winning the liquid biopsy race than this. Sadly, the best cfDNA tests may not actually win the cfDNA population cancer screening race. Indeed, like everything else in life, marketing, politics, etc., will play a marked role here.

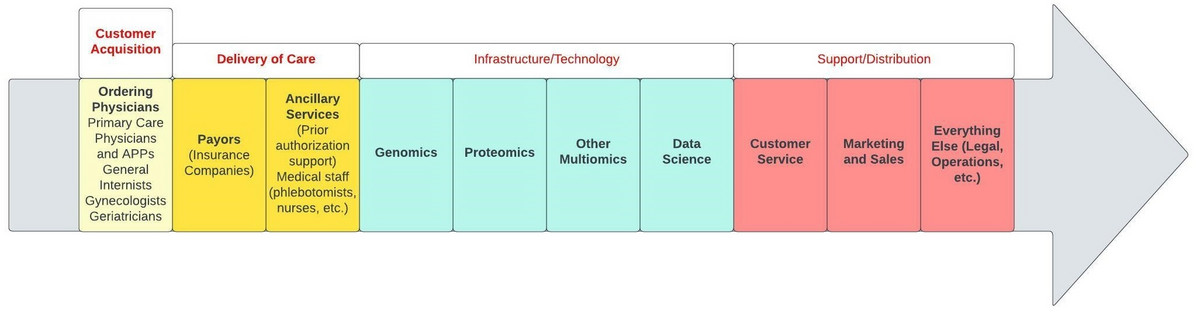

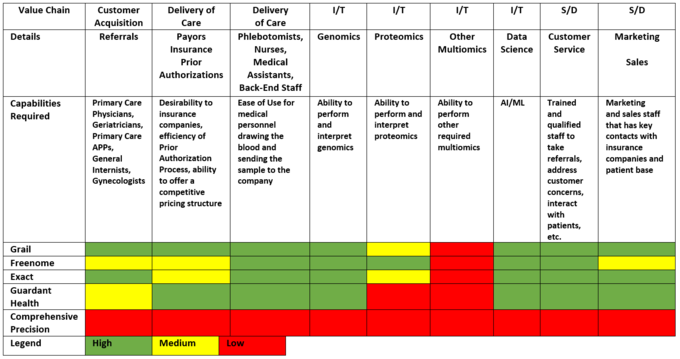

There are numerous facets to the remedial value chain for population cancer screening using cfDNA (figure 9).

Figure 9: Remedial population health cancer screening value chain

Initially, the test has to be ordered by a physician. The test ideally would be covered by insurance, and drawing of the required sample, and insurance authorization of the test, should be facile. The sample needs to be procured and processed as the logistics and genomics, proteomics, multiomics, and data science capabilities of the company are paramount. Supporting the entire process one must have tremendous customer service for patients, ordering providers, and their staff. Marketing and sales teams are critical to success, as are operations, legal, etc.

An overly simplified, and likely somewhat incorrect, application of the value chain to Grail, Freenome, Exact Sciences, and Guardant Health, demonstrates they are all excellent companies that are well positioned (figure 10). However, Grail is profoundly ahead of their competitors and has very few overt weaknesses.

Figure 10: Application of the value chain to Grail, Freenome, Exact Sciences (Exact), Guardant Health, and our hypothetical company, Comprehensive Precision. Green represents significant proficiency, whereas red represents weakness, and yellow is in-between.

Comprehensive Precision strategy for entering the cfDNA population health cancer screening market

Despite admonishing the board about the hostile cfDNA population health cancer screening market, they implore you to enter the fray. You are extremely nervous about this proposition, but begin identifying strategic control points for success. Because Grail is clearly the strongest company in the industry presently, you focus on how you can compete with them, including:

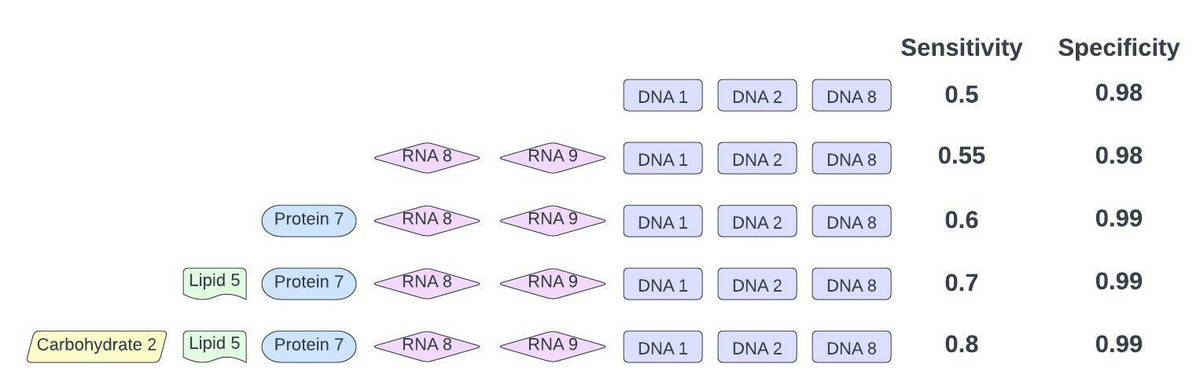

- Sensitivity and specificity for early-stage disease: Grail’s weakness, if there is one, is that Galleri was relatively poor at detecting early-stage disease with an overall sensitivity of 16%. Although you’re certain Grail will improve on this through ongoing studies, you note there is substantial opportunity for a competitor that can dramatically improve sensitivity for stage 0/1 disease, if it’s possible. Quite simply, if you are better at detecting cancer earlier than Grail, you can aggressively market that. Obviously, this is much easier than done, but you suspect multiomics is the key (figure 11).

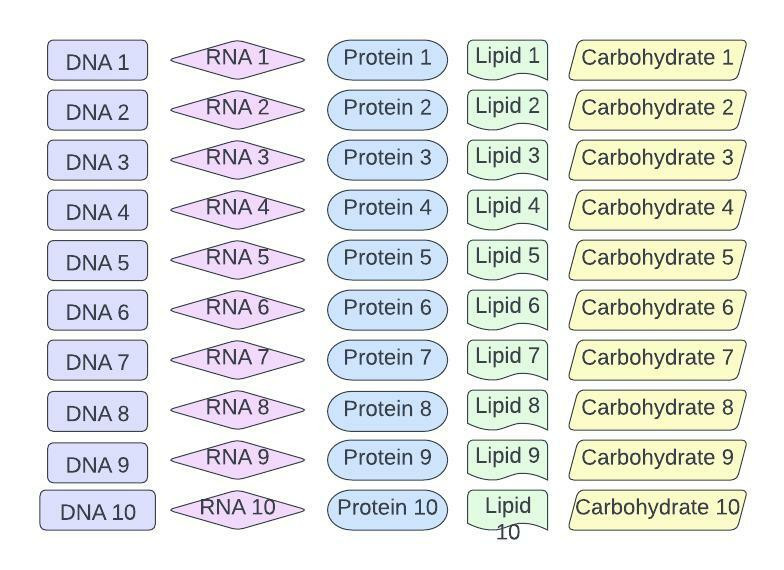

Figure 11: Potential multiomics sampling for population health cancer screening

Specifically, you postulate that a broader testing platform may enable better early cancer detection than Galleri. You speculate that using a combination of lipidomics, glycomics, proteomics, RNAomics, proteomics, genomics, etc, may outperform Galleri in terms of sensitivity and specificity (figure 12).

Figure 12: COMPLETELY hypothetical example of multiomics outperforming genomics in population health cancer screening. The data set for this example is in Figure 11.

However, you’re aware the cost of such a test may be prohibitive. Nonetheless, there is an opportunity here to let Grail blaze a path to routine use of cfDNA in population health, and usurp them after.

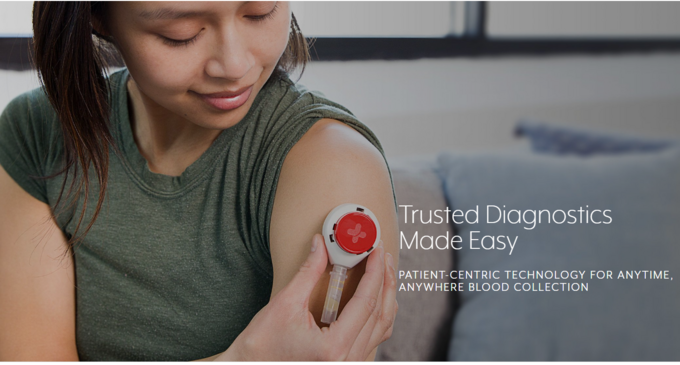

- Direct to consumer: Grail’s test requires a prescription from a physician and a relatively large amount of blood. It cannot be performed in the patient’s home without a qualified medical professional. Accordingly, in the same vein as 23 and Me, if one could market directly to the consumer, it could be beneficial. Better yet, if one can eliminate the need for a health care provider and visit to the physician’s office, it could be very financially lucrative. Tasso has a device that allows patients to self-draw blood, but the amount that can be obtained is far less than conventional phlebotomy (figure 13). Accordingly, for Comprehensive Precision to be able to circumvent physicians and enable patients to order and perform tests on themselves, it would need to develop a test that requires far less blood than Galleri. This may be technically infeasible, but it’s conceivable a test patients can do at home could disrupt the population health cancer screening market.

Figure 13: Tasso device for self-blood draw.

- Price: Grail is offering the Galleri test at $949. This actually seems pretty reasonable. If one could undercut Grail substantially in terms of price, there may be a path to success, but this seems largely impossible due to Grail’s partnership with Illumina, need for potential multiomics, etc.

- Vertical integration with ancillary services: Grail adeptly established collaborations with numerous institutions, such that patients identified as potentially having cancer are referred to participating centers. As a hematologist/oncologist you find this disconcerting as Grail is influencing a patient’s care in ways they should not. Nonetheless, providing patients with cancer counseling, direct patient advice, etc., may be a key differentiator for companies.

- Target everyone: Early cancer detection benefits everyone who develops cancer, not just at-risk individuals. If one could develop a test that was cost-effective enough, it’s possible it could be routinely ordered for all patients, not just adults at high risk.

- Make it part of a package: You suspect Grail wants to be used as a screening test patients undergo at their annual physicals. You consider the possibility that a single lab panel that includes cancer screening, lipids, blood counts, renal function, liver function, etc., may be attractive to ordering physicians and facilities. Accordingly, partnering with Labcorp, Quest, etc., may enable one to make a “preventive health package” including a cancer screening offering.

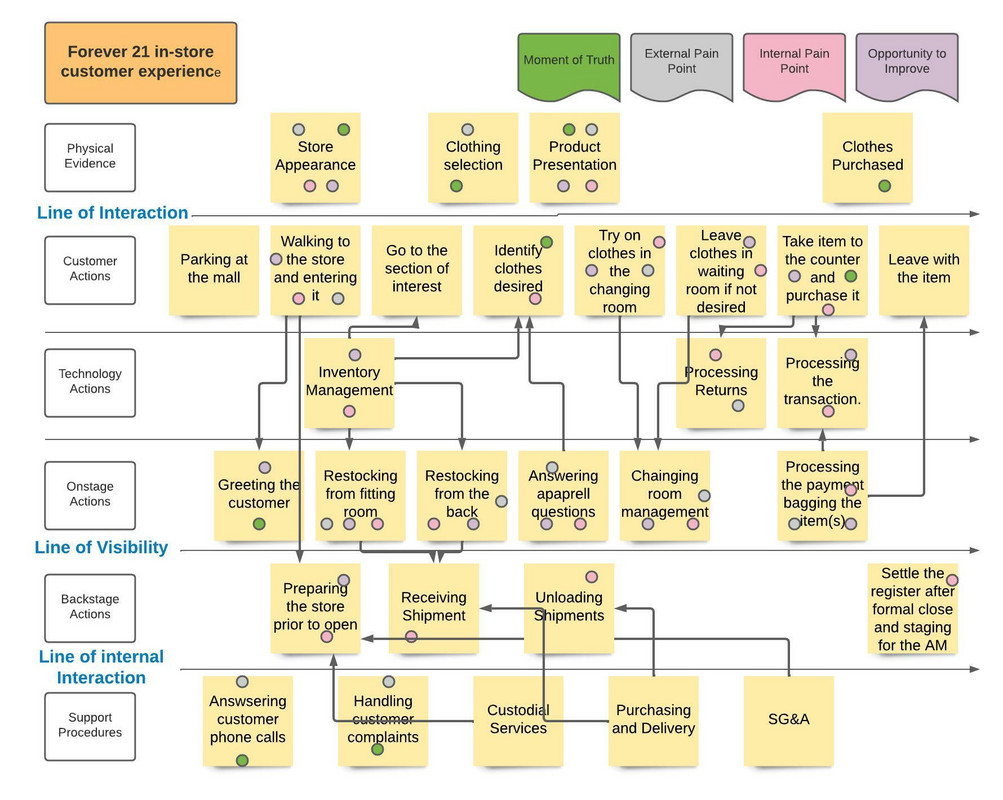

- Make the ordering process as easy as possible: One of the primary factors you’ve seen physicians use to determine which company to use for precision medicine is the ease of the ordering process. Office staff fills out paperwork and requests insurance authorization when next generation sequencing on a patient’s tumor is requested. This can be a painstaking process. Incorporation of the test into the EHR, like Guardant Health is doing with EPIC, greatly simplifies the ordering process, and is a strategic control point. To this end, you note that every company should perform a customer service blueprinting exercise at the patient, office staff, and physician level [15].

Figure 14: Example of a hypothetical customer service blueprint for the clothing store FOREVER 21 I completed during my MBA and UNC-Chapel Hill.

- Turnaround time: Turnaround time for the Gallari test is approximately 10 days. It’s hard to improve on this, but to compete with Grail your test cannot take much longer than 10 days.

- Quality of the output: Your colleagues have used a lot of precision medicine companies to test their cancer patients, including Tempus, Neogenomics, Caris, Foundation Medicine, Guardant Health, and Protean Biodiagnostics. You recall them telling you how much they appreciate when reports are informative, well organized, etc. The little things matter and Comprehensive Precision must attend to them.

- Number of malignancies: Grail tests for 50 malignancies simultaneously. That is difficult to beat.

- Unique partnerships: Grail is off to a massive head start. However, there are still many institutions, government organizations, etc., that do not have a population health cancer screening partner. Aggressive pursuit of these would be warranted.

- Focus on stage 0/1 disease: Grail’s weakness is in the stage 1 space. Intuitively, if you can convincingly demonstrate your test identifies cancer earlier and more reliably than Grail you can market that heavily.

- Different tissue (saliva, inhaled, etc.): Patients prefer not to have a needle stick if they can avoid it. Less invasive testing may be a differentiator if sensitivity and specificity are preserved. Indeed, there are companies doing breath tests to determine if patients have lung cancer.

- Beat Grail handily at a given malignancy: It may be impossible to develop a multicancer detection test that can surpass Grail because of the profound amount of data they can access. However, one could identify a single tumor type to best Grail at. This is the approach companies like Delfi (lung), Exact Sciences (liver), Natera (colon, bladder), Freenome (colorectal), Guardant Health (colorectal), etc., are taking. It’s the appropriate approach, but there is concern Grail’s multicancer option may prove more attractive to ordering physicians than obtaining multiple tests from different companies to assess for different malignancies.

- Market properly: If you have a test that beats Galleri on sensitivity, while matching their specificity, you need to market the test appropriately. Chances are you will need to remind patients and physicians the importance of sensitivity, and why they should order your test over Galleri, especially given how aggressively Illumina/Grail will market Galleri. They have already partnered with the PGA tour, and you fully anticipate seeing Galleri marketed during NFL, NBA, NHL, and MLB events.

After presenting the aforementioned strategy to your board they green light the project. You leave the room exhausted, knowing what you just conveyed was rather trivial. Indeed, you could have talked for days about the nuances of the cfDNA market and how arduous it is. Nonetheless, you are scheduled to talk to the board one final time tomorrow about the remaining cancer-related cfDNA applications you touched on in Chapter 1. You get in your Uber and close your eyes en route to your hotel. You think to yourself, “it’s tough being the CEO of Comprehensive Precision”.

Concluding Remarks

My initial intention with this chapter of the “The Hitchhiker’s Guide to Cell-Free DNA” was to touch on the role of liquid biopsy in the detection of every type of malignancy. However, after researching the article more it became obvious there was no value to the reader in this. The short answer is that we should use liquid biopsy to detect every type of malignancy we can, although it will be harder for some than others.

My father, who has a Ph.D. in biochemistry, and was head of the signal transduction group at Promega for approximately 30 years, and I, talk all the time about novel companies, new therapeutics, potential experiments, etc. One of the greatest gifts I was given in life was having a father that shares the same interests as me; a father that sends me numerous scientific articles every day to read. The first time I ever saw a cancer cell in my life I was 4-years-old in my dad’s lab where he was working on prostate cancer. In fact, I grew up in that lab. When I was 16, I worked on the development of a protein kinase assay in my father’s lab at Promega that yielded 3 first-author publications before I was 20. Thereafter, I went on to complete my Ph.D. in biochemistry at the Mayo Clinic and post-doctoral fellowship at Stanford, stories best left for another day.

Just before Grail was purchased by Illumina in 2021, my father and I talked about buying into their upcoming initial public offering (IPO). We knew long before then the potential of Grail’s Galleri test, and nothing I wrote today dissuades me from believing Grail will be successful. Nonetheless, the Galleri test isn’t perfect, and there is room for the RIGHT competitors. Who those will be remains to be seen. Freenome, Guardant Health, Natera, Exact Sciences, etc., have compelling offerings that rival, or best, Grail in colorectal, bladder, and hepatocellular cancer, but Grail is not resting.

After reading this, it may appear I’ve left you with more questions than answers. I suppose that was the point to some extent. However, I will make a few definitive statements. I do feel there is some validity to Grail’s contention they can detect 50 cancers from a single vial of blood. I do feel we will be using liquid biopsy in population health cancer screening routinely relatively soon. I expect them to become integral components of annual well check visits, and to save lives. I am preparing to live in a world, as an oncologist and a patient, where these tests are ubiquitous and routine. I implore everyone to do the same.

In the next edition of “The Insider’s Guide to Translational Medicine” we will conclude our tour of cell free DNA and liquid biopsy in Chapter 3 of a “Hitchhiker’s Guide to Cell Free DNA”. We will focus on cfDNA applications for drug development, predicting treatment response, and guiding cancer therapy.

As you are CEO of Comprehensive Precision you will be presenting to your board again tomorrow. I suggest you get some rest. You’re going to need it!

References

3. E.A. Klein,D. Richards,A. Cohn,M. Tummala,R. Lapham,D. Cosgrove,G. Chung,J. Clement,J. Gao,N. Hunkapiller,A. Jamshidi,K.N. Kurtzman,M.V. Seiden,C. Swanton,M.C. Liu. Clinical validation of a targeted methylation-based multi-cancer early detection test using an independent validation set. Annals of Oncology, September 2021.

4. https://www.precedenceresearch.com/liquid-biopsy-market

5. https://www.nytimes.com/2022/02/10/business/illumina-gene-sequencing-ftc.html

6. https://www.ftc.gov/competition

7. https://www.fiercebiotech.com/medtech/illumina-completes-grail-acquisition-regulators-be-damned

9. https://grail.com/our-products/

10. freenome.com

11. https://bmccancer.biomedcentral.com/articles/10.1186/s12885-019-6003-8

12. https://www.exactsciences.com/

13. https://www.science.org/doi/10.1126/science.abb9601

14. https://guardanthealth.com/

15. https://www.youtube.com/watch?v=-glgJ9U_Fsk