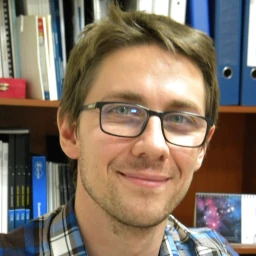

Andrii Buvailo, PhD

Dr. Andrii Buvailo is a pharmaceutical industry analyst, tech scout and writer with a focus on artificial intelligence (AI) in drug discovery and biotech, digital transformation of pharma industry, and the advent of novel therapeutic modalities.

Andrii’s reports touch upon disruptive biotech startups, venture capital deals, drug discovery IPOs and platform companies. His articles were published on Forbes, and market research reports were referenced by some of the leading organizations (e.g. Deloitte).

Andrii is an ex-Enamine veteran, having served for the company as Director of E-commerce and Marketing for more than 8 years. Enamine is a global supplier of fine chemicals and compound libraries for the pharmaceutical industry.

Before venturing into the pharmaceutical industry and media entrepreneurship, Andrii used to work as a scientist. He holds PhD in Physical Chemistry, and has research experience in bioinorganic and supramolecular chemistry, thin polymer films, nanomaterials, and sensors.

Andrii is Ukrainian, currently based in Spain.

Author in

Marketing & E-commerce

AI & Digital

Bioeconomy & Society

Startups & Deals

NeuroTech

Clinical Trials

Biotech

Manufacturing & Pharma 4.0

Tools & Methods

HealthTech

Aging & Longevity

Contract Research

Novel Therapeutics