The Evolution Of Pharmaceutical R&D Model

There is a plethora of analytics reports, including ones by Deloitte, DKV Global, and Ernst and Young, all pointing out to a declining business performance of the pharmaceutical industry. They all convey a similar bottomline message: the decline is not due to a lack of innovation (the innovations are growing). And not because sales are falling or markets are shrinking (revenues are growing in general, and the markets are expanding with the expanding and ageing population). The key reason of the declining financial performance is the fact that research and development (R&D) costs are growing substantially faster over an average investment period, than the actual revenues over the same period. This kills operational profits, leading to a decline in the overall business gain. A direct consequence of that -- an increasingly stagnating industry, cutting sometimes promising R&D programs, jobs etc.

There are two more relevant questions here:

1) why R&D costs are growing faster than revenues, considering that technological progress is seemingly providing more and more optimal and powerful technologies to pharma companies at a constantly decreasing specific price (e.g. costs of computation, sequencing, screening and many other things are falling), and

2) what to do about it to reverse the decline in pharma industry performance?

Reasons of declining returns on research capital

Trying to find answers to the above questions, I stumbled upon one nicely crafted financial model of the pharmaceutical industry in a post “Pharma's broken business model: An industry on the brink of terminal decline” by Kelvin Stott, an experienced consultant and executive, which suggested that the nature of the industry’s declining productivity is conditioned by the “law of diminishing returns”. Simply put, pharma companies have already picked all the “low hanging fruit” among successful drug ideas, and now it takes more and more effort and money to get any new marginal progress over the currently available options, with constantly diminishing returns.

However, when you consider a plethora of recent groundbreaking advances in pretty much every aspect of biology, chemistry, modelling, and all related science areas, plus a wide array of novel enabling technologies, developed or adopted by pharma companies over the years (for example, read "Top 7 Trends In Pharmaceutical Research In 2018", and "Hot" Research Areas in Drug Discovery - 2019" for a quick reference), it feels countre-intuitive to think about “diminishing opportunities”.

A more natural reason, from my point of view, was outlined in a Forbes post by Standish Fleming, founding managing member of Forward Ventures, and a veteran of venture capital investing in therapeutics discovery, who pointed out two more credible (and seemingly less regarded) aspects of the existing decline in the pharma industry -- the inherent unpredictability of drug discovery endeavor, and an outdated business model of drug discovery, not accounting for the uncertainty efficiently.

Essentially, unlike most traditional businesses (for instance, construction, automobile development, internet technologies etc), where the product development phase is an engineering task, which can be substantially improved with more tech and talent thrown at it, drug discovery endeavor is experimentation from day zero. Considering a current chances of success for a compound entering clinical trials to be below 10%, the drug discovery resembles a lottery.

Even worse, the process can not be gradually optimized using a well-known “market-product fit” strategy, used in more “engineering” industries like, say, software manufacturing. This strategy allows creating an early prototype of, say, a mobile app (a minimal viable product, or MVP), then getting early feedback from customers (“early adopters”), upgrading based on the feedback, repeating this exercise, etc. -- all the way till the market is satisfied with the app and is ready to buy.

By analogy, clinical trials in humans serve as that “early feedback”, and any negative feedback immediately kills the whole discovery program, adding enormous costs to the aggregate R&D expenses.

Other reasons also contribute to the rising cost of R&D, of course: FDA regulations taughen, requiring more experiments, more cost; standards of healthcare constantly improve, making it harder to innovate over the current state; and yes, to some extent, the “law of diminishing returns” from Kelvin Stott‘s model also influences the rising scrutiny, albeit not as dramatically as the high failure rates.

"Traditional" pharmaceutical business model needs revision

Having reflected on the above situation with the fundamental unpredictability of the drug hunting experience, it becomes more intuitive that the “traditional” business model of the pharmaceutical industry might not be perfectly aligned with the nature of things. As Standish Fleming points out, most big pharma companies are optimized for “high-quality, low-volume, high-cost strategy” of early drug discovery. While every effort is made to assure drug targets are selected right, and lead molecules are properly developed, only singletons typically survive their way to clinical trials, and from that point even smaller number of those (if any) are ever developed into the approved and marketed drugs. The reason for this low success rate, notwithstanding enormous R&D efforts, is just that -- the inherently unpredictable outcome of trying to influence human biology (at least, at this stage of scientific progress).

The high failure rates in clinical trials appear to be adding up huge overheads to the overall R&D expenses, making it very hard to generate positive return on R&D, diminishing general performance indicators (e.g. Internal rate of return, IRR). According to DiMasi et al., it is the cost of drug candidate failures and out-of-pocket expenses, that contribute most to the overall drug development costs.

The new model

Clearly, the new model of the pharmaceutical industry needs to be accounting for the intrinsic unpredictability of research results. The only way to do that is to shift the focus of early drug discovery efforts from “high-quality, low-volume, high-cost” approach to a more statistical “low-cost, high-quantity strategy”, with a focus on working with external sources of innovation (biotech startups, academics). Shifting focus from extensive internal R&D to external entrepreneurial and research community is a way to run numerous programs at relatively lower cost, in a more flexible way. It is then possible to achieve statistically significant number of early attempts, to increase the probability of successful outcomes.

Somewhat illustrative example in this context is a so called “seed-led venture creation model” practiced by a successful biotech venture fund Atlas Ventures. It deals, on the one hand, with relatively small initial investments to crash-test key research ideas of many startups under management. On the other hand, every effort is made to elaborate on the “virtual model of drug discovery”, when newly formed companies have to leverage CROs and partners from around the world to assemble expertise on an as needed basis, rather than investing hugely in own capability development at early stages. Initial focus on crash-testing early research with small budgets and flexible outsourcing models of early growth allowed Atlas to gain successful results with biotech startups over many years.

Below is a list of the key features of the new “statistical model” of drug discovery business (“low-cost, high-quantity strategy”):

- Venture-capital approach to early drug discovery -- as many lower-budget milestone-based “proof-of-concept” projects as possible -- via accelerators and venture funding programs for startups, academics, open innovation practitioners. And through sponsoring other venture funds.

- The role of external R&D outsourcing for the validation of early results and for further, more rigorous, preclinical discovery has to become dominant. This is dictated by the importance to be able to abort the unfavorable projects flexibly-` and quickly, without much investments into the internal assets development.

- Internal focus has to be shifted to the management of numerous external innovations

- A more rigorous statistical validation has to be implemented (“killer experiments” to abort unfavorable projects early and at minimal cost)

- The main internal focus has to remain on only the core R&D programs, the IP development and management, management of multiple external innovative projects, running clinical trials, go-to-market activities, and sales.

- Pharma players have to create the whole innovative entrepreneurial communities around their accelerators and special funds.

- Adopting artificial intelligence (AI) to operational tasks: management of numerous external innovation projects, financial planning and risk assessment; management of clinical trials; go-to-market activities, etc. In contrast to fundamental research tasks, where AI value is not yet clear, tackling operational tasks seems already beneficial, according to Vas Narasimhan, CEO at Novartis.

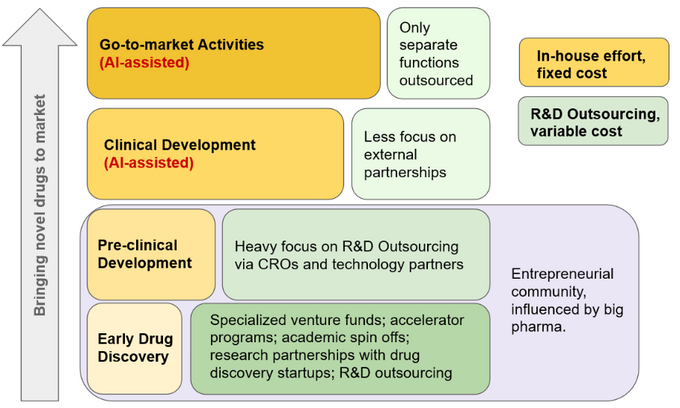

Below are a table and a diagram illustrative a very rough distributino of efforts between in-house activities and external R&D outsourcing:

| In-house efforts/asset development | External efforts | |

| Early hit exploration/identification | + | ++++ |

| Hit-to-lead/lead optimization | + | ++++ |

| Preclinical development | ++ | +++ |

| Clinical development (AI-assisted) | ++++ | + |

| Regulatory paperwork, IP-related | +++ | ++ |

| Go-to-market activities (AI-assisted) | ++++ | + |

In order to make it possible to run numerous early drug discovery initiatives in parallel to gain statistical effect, it will be necessary to create special management infrastructure to work with external sources of innovation. Those can be specialized funds and accelerator programs to deal with promising innovations not only from academic labs, but also from emerging hi-tech and biotech startups and open source initiatives.

Besides funds, the whole entrepreneurial community has to be created and maintained, which would become a source of constant innovation, which is to be constantly assessed within the framework of the above discussed statistical model.

How the new model will be changing the pharma industry?

There are signs that big pharma is already making steps to shape a more agile approach to generating innovations and bringing them to market, for example, by chasing external partnerships with drug discovery startups, and engaging in more R&D outsourcing activities. Apparently, this trend will be growing, and there are some consequences that will be seen in the coming years:

-

The number of partnerships between big pharma and “high-tech” or “biotech” niche startups, technology providers, and academic labs will be skyrocketing, as pharma will be increasingly competing for external innovation.

-

A number of special development funds (similar to VC-funds) backed by pharma companies and specialized accelerator programs will be skyrocketing. One of the current examples of this kind is Jlabs network of accelerators. Such examples will most probably become a mainstream paradigm with large pharma companies.

-

Pharma R&D outsourcing will be growing significantly, and will be spanning more areas of R&D, traditionally done by pharma companies internally. R&D outsourcing will become a central strategy for identifying, testing, and scaling innovations in drug discovery space.

-

Artificial intelligence will be adopted by big and middle pharma at corporate scale -- but mostly not for the early research purposes (like biology research or hit discovery), rather -- for the organization-wide operational activities: innovation management and risk assessment; financial management of external innovation programs; clinical trial planning and management; go-to-market activities planning, etc.