Insilico Medicine Goes for Hong Kong IPO, Aims to Raise $292M

AI drug developer Insilico Medicine has returned to the Hong Kong public markets with an updated IPO prospectus, targeting about $292 million in proceeds. The submission marks the company’s fourth bid to list on the Hong Kong Stock Exchange, and comes after a year that included a $123 million oversubscribed Series E, an expanded $100M AI drug discovery R&D and licensing collaboration with Eli Lilly, and Phase 2a clinical data for its lead idiopathic pulmonary fibrosis candidate being published in Nature Medicine.

According to the prospectus, Insilico intends to offer more than 94 million shares priced at HKD 24.05 per share, equivalent to roughly $3.09. About 10 percent of the shares are earmarked for the Hong Kong market, with the remainder placed internationally. The offering is scheduled to close on December 23, with trading expected to begin on December 30. The IPO is backed by a group of cornerstone investors committing a total of $115 million, including Tencent and Eli Lilly, each investing $5 million.

Founded in 2014, Insilico develops generative AI systems for drug discovery through its Pharma.AI platform, spanning target identification, small-molecule design, and clinical outcome prediction. The company maintains operations in Hong Kong, Shanghai, Taipei, Boston, New York, Montreal, and Abu Dhabi, and runs a dual model combining internal drug development with platform licensing and discovery collaborations for pharmaceutical partners.

The IPO filing follows a series of financing and partnership milestones earlier in 2025. In March, Insilico raised $110 million in a Series E, later expanded to $123 million in an oversubscribed close in June. According to prior disclosures, the round exceeded the company’s annual R&D spending in both 2022 and 2023. Total venture funding raised to date now exceeds $500 million, with investors including Warburg Pincus, Qiming Venture Partners, WuXi AppTec, B Capital Group, Prosperity7, OrbiMed, Deerfield, Pavilion Capital, CPE Fund, Mirae Asset Capital, Lilly Asia Ventures, Eight Roads, Baidu Ventures, Sinovation Ventures, and others.

On the partnership side, Insilico expanded its relationship with Eli Lilly in late 2025, building on a 2023 software licensing agreement. Under the updated research and licensing collaboration, Insilico applies its Pharma.AI platform to generate and optimize compounds against jointly defined targets, with the deal carrying more than $100 million in potential upfront and milestone payments. The company has also disclosed collaborations with Exelixis, Fosun Pharma, and Menarini Group.

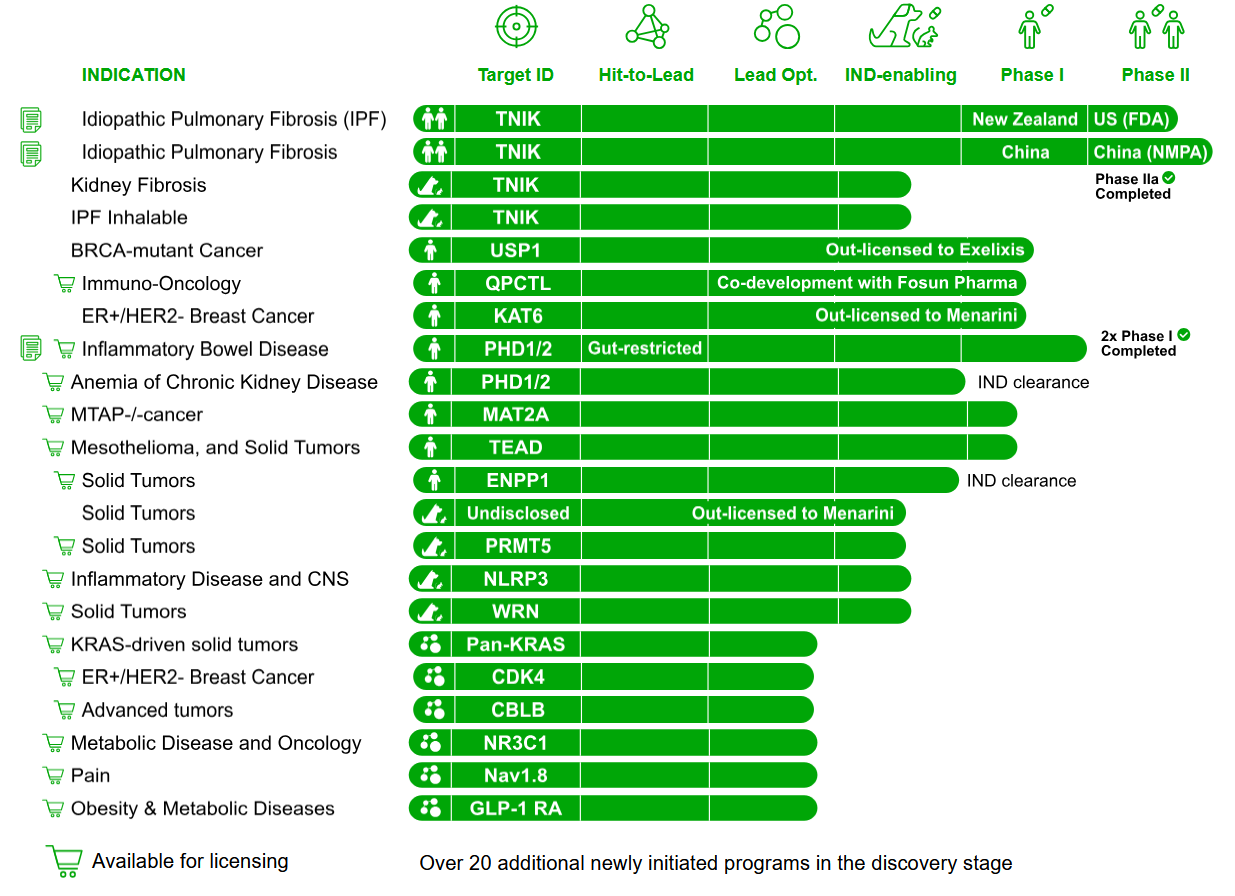

Insilico has long pointed to development speed as a differentiator. In February 2025, the company reported benchmarking data from 22 AI-designed programs, showing an average time of about 13 months from initial molecular library generation to nomination of a preclinical candidate, compared with reported industry timelines of 2.5 to 4 years. The company states that it has nominated 22 preclinical candidates since 2021, with a broader pipeline of 31 programs and 10 IND-approved assets discovered using its platform.

Insilico Medicine’s 31 programs, with 22 preclinical candidates nominated since 2021 and 10 IND-approved assets, all discovered using its Pharma.AI platform.

Its most advanced internal asset is rentosertib, formerly ISM001-055, a small-molecule TNIK inhibitor for idiopathic pulmonary fibrosis. The program first gained attention in 2021 when Insilico reported identifying a novel IPF target, designing a matching molecule, and completing preclinical work within 18 months at a reported cost of about $2 million. Rentosertib has since completed early safety studies and a phase 2a placebo-controlled trial in China involving 71 participants, showing improvements in lung function. Results were published in Nature Medicine in June 2025. Further studies in kidney fibrosis and an inhaled formulation for IPF are planned for 2026. Other clinical-stage assets include ISM5411, a gut-restricted PHD1/2 inhibitor for inflammatory bowel disease that has completed Phase I.

Financially, the prospectus reports $85.8 million in revenue for full-year 2024, with a net loss of $17.4 million. For the first six months of 2025, revenue reached $27.5 million, while net losses totaled $18.9 million. The filing comes amid a mixed backdrop for AI-focused drug discovery companies, with some peers pursuing mergers, others downsizing, and newer entrants raising large private rounds rather than entering public markets.

Topic: Biotech Ventures