A Booming Anti-Obesity Drug Discovery Landscape at a Glance (With Challenges)

In 1986, Danish scientist Jens Juul Holst discovered that the gut hormone GLP-1 stimulates insulin and suppresses appetite. This research led to the development of two blockbuster weight-loss drugs: Wegovy by Novo Nordisk and Zepbound by Eli Lilly, now prescribed to millions as obesity affects 1 in 8 people globally.

Since Wegovy's 2021 launch and Zepbound's approval five months ago, Novo Nordisk and Eli Lilly are leading the next generation of weight-loss drugs, targeting a market projected to reach $150bn by 2030. Currently, 232 anti-obesity drugs are in development, with the most advanced utilizing GLP-1 combined with other hormones.

Novo Nordisk and Eli Lilly, who initially received approval for GLP-1 treatments for diabetes in 2005 and 2010, respectively, are now advancing five new weight-loss drugs in phase 3 trials. Novo Nordisk's CagriSema, targeting over 20% weight loss, and Eli Lilly's retatrutide, showing a 24% weight reduction in early trials, are notable candidates.

Novo Nordisk is also developing amycretin, a promising pill combining GLP-1 and amylin. Analysts like Emily Field from Barclays note these companies continually set higher standards.

The Weight-Loss Drug Market Getting Crowded

The race to dominate the lucrative weight loss drug market is heating up as demand for these treatments continues to surge. Currently, Novo Nordisk and Eli Lilly are the clear frontrunners, capturing the lion's share of attention and sales. Their blockbuster drugs have generated immense demand, even leading to occasional shortages. But the market, projected to be worth tens of billions of dollars within a decade, has room for more players.

Emerging Competitors

While Novo Nordisk and Eli Lilly hold dominant positions, several lesser-known companies are making significant strides to enter the market. These emerging competitors see a unique window of opportunity to carve out their niche in this booming sector.

Boehringer Ingelheim is developing a promising weight loss drug in collaboration with Zealand Pharma. Their experimental treatment, named survodutide, targets two gut hormones—GLP-1 to suppress appetite and glucagon to increase energy expenditure. Mid-stage trials have shown that patients lost up to 19% of their body weight after 46 weeks, with potential for even greater results in late-stage trials.

Terns Pharmaceuticals is in the early stages of developing an oral weight loss drug that targets GLP-1. Initial 28-day trial data is expected in the second half of 2024. Although Terns is in the nascent phase compared to Boehringer Ingelheim, the company is optimistic about its potential to capture even a small percentage of the estimated $100 billion market.

Viking Therapeutics is another contender, focusing on drugs that target both GLP-1 and GIP hormones, similar to Eli Lilly's treatments. Viking plans to release mid-stage trial data on its weight loss injection soon, with an early-stage study showing up to 7.8% weight loss after 28 days. Additionally, the company is developing an oral version of this drug, with phase one trial data expected shortly.

Structure Therapeutics is working on an obesity pill. Although their mid-stage trial results fell short of Wall Street’s expectations, showing a 5% weight loss compared to placebo over eight weeks, the company is continuing its efforts. Full 12-week results are expected in the second quarter of this year, followed by a larger mid-stage study and a late-stage trial.

Altimmune has seen a substantial stock increase, nearly 250% since releasing mid-stage trial data for its experimental injection, pemvidutide, which targets GLP-1 and glucagon. This drug has shown an average weight loss of 15.6% over 48 weeks.

The Role of Big Pharma

Several large pharmaceutical companies are also eyeing the weight loss market. Pfizer, Amgen, Roche, and AstraZeneca have all outlined strategies to join this lucrative field. Despite some setbacks, such as Pfizer's challenges with its weight loss drug program, these companies remain committed to entering the market.

Sanofi, having experienced a mid-stage trial failure with a previous GLP-1 drug, is exploring potential next-generation treatments that could offer fewer side effects. The company is focused on what the future wave of weight loss drugs might look like. Similarly, Bayer has expressed interest in the obesity market, potentially through partnerships rather than independent development.

Market Potential and Strategic Moves

Goldman Sachs analysts predict that 15 million U.S. adults will be on obesity medications by 2030, indicating substantial growth potential. This anticipated demand leaves room for both established giants and new entrants.

Smaller biotech companies may find their way into the market through strategic buyouts or partnerships with larger pharmaceutical firms. The push to develop oral weight loss drugs, which are easier for patients to take and simpler for companies to manufacture compared to injections, is a significant trend among these smaller players.

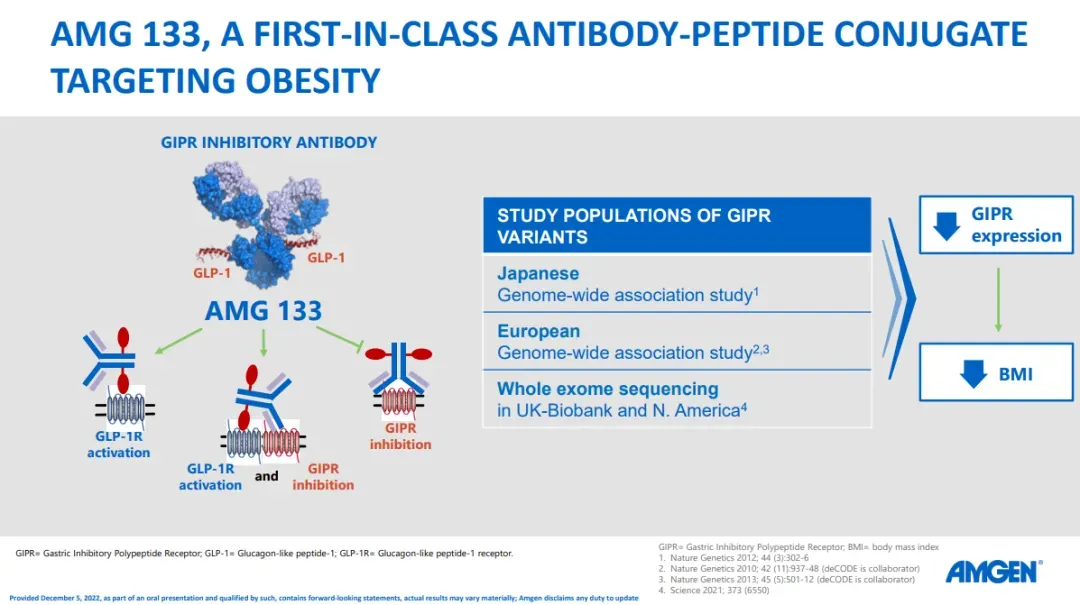

Amgen's Unique Approach to Weight-Loss Drugs

Amgen is developing an injectable weight-loss drug called MariTide, aiming to differentiate itself in a competitive market dominated by Novo Nordisk and Eli Lilly. Unlike existing treatments, MariTide helps patients maintain weight loss even after they stop taking it and offers the convenience of less frequent dosing, potentially once a month or even less.

Image credit: Amgen

Key Features and Strategy:

-

Mechanism of Action:

-

MariTide activates the GLP-1 receptor to regulate appetite, similar to Wegovy and Zepbound.

-

Unlike Zepbound, which activates the GIP receptor, MariTide blocks it. Blocking GIP is believed to reduce fat mass and body weight, based on genetics research.

-

-

Dosing Convenience:

-

Current leading drugs require weekly injections.

-

MariTide’s prolonged effect could allow for monthly or even less frequent dosing, providing a significant convenience advantage.

-

-

Early-Stage Results:

-

In a small phase 1 trial, patients on the highest dose of MariTide lost 14.5% of their body weight in 12 weeks.

-

Single injections showed prolonged effects, with weight loss sustained for months after the last dose.

-

-

Long-Term Efficacy:

-

Early data suggest MariTide may help maintain weight loss longer than existing treatments.

-

Patients maintained up to 11.2% weight loss five months after their last dose.

-

-

Future Prospects:

-

Initial data from a mid-stage trial and phase 1 results on an oral obesity drug are expected later this year.

-

Amgen is exploring even less frequent dosing in ongoing trials, which could further enhance convenience.

-

Amgen’s unique approach and early promising results position it as a potential significant player. Amgen’s strategy hinges on offering a novel mechanism of action and more convenient dosing schedules, aiming to carve out a competitive niche in the burgeoning weight-loss drug market.

Anti-Obesity Frenzy Through the Lenses of Stock Markets

According to Barclays Bank analysts, this burgeoning sector could be worth up to $200 billion within the next decade. As a result, major pharmaceutical companies are ramping up their research and development spending, alongside an increase in mergers and acquisitions, to capitalize on this lucrative opportunity.

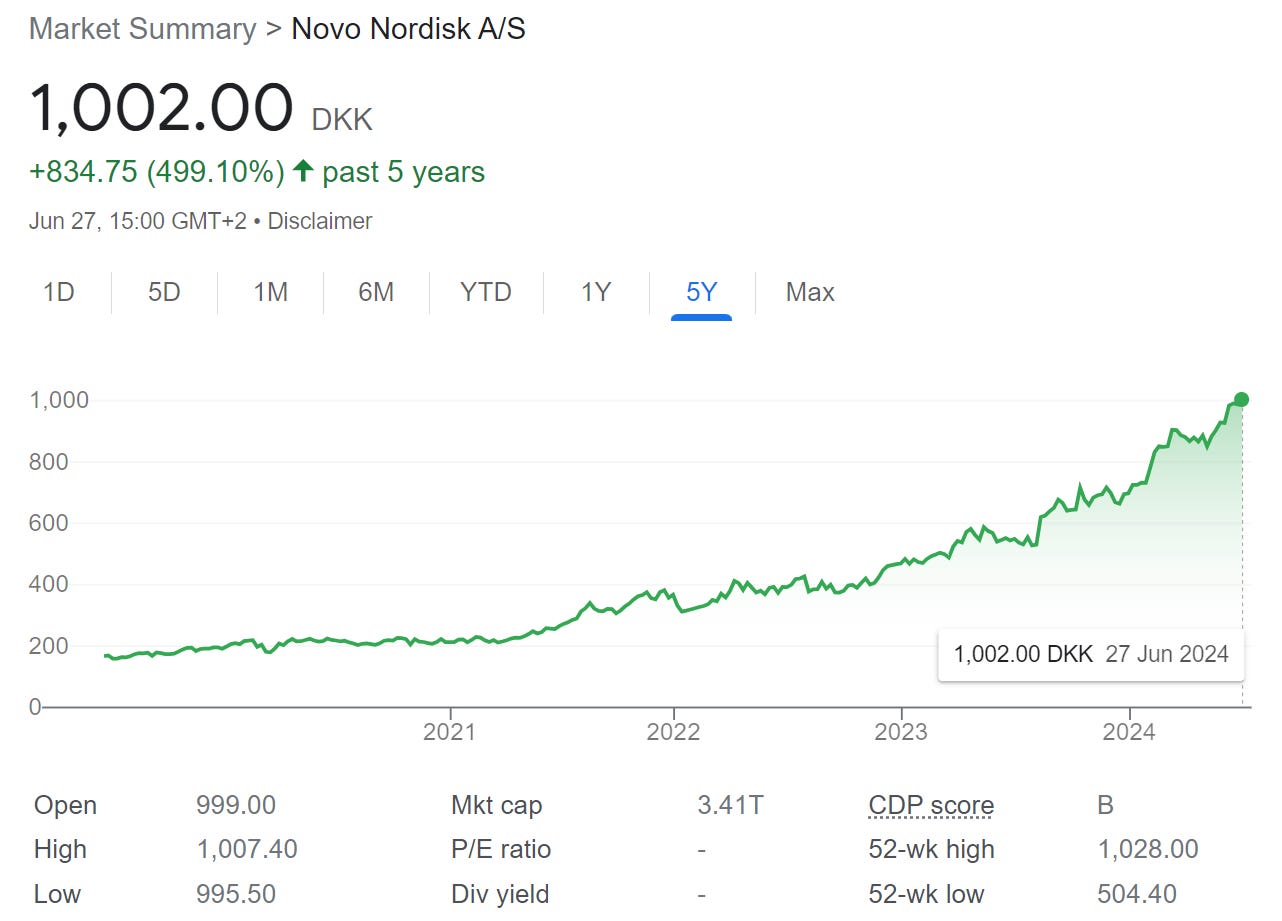

Soaring demand for weight loss drugs, specifically GLP-1 agonists, has propelled Novo Nordisk and Eli Lilly closer to potentially becoming the first pharmaceutical companies with market capitalizations exceeding $1 trillion. Despite only 1% of the global obese population being treated with these drugs so far, the companies are experiencing rapid stock price increases and significant sales growth, indicating early stages of a long-term trend.

AstraZeneca has seen significant growth, reporting a 19% increase in first-quarter revenue to $12.68 billion. This rise was primarily driven by oncology, yet the company is strategically pivoting towards weight-loss solutions. In late 2023, AstraZeneca secured the rights to an experimental weight-loss pill from China’s Ecogene, committing up to $2 billion. Sharon Barr, AstraZeneca’s Executive Vice President of BioPharmaceuticals R&D, emphasized their aim to provide long-term weight management, moving beyond short-term weight loss.

Roche, another major player, is re-entering the weight-loss market to offset declining oncology sales. Having previously abandoned GLP-1 drugs in 2018, Roche made a significant move in December by acquiring obesity drug developer Carmot for $2.7 billion. Carmot’s leading drug candidate is advancing to mid-stage human trials, reflecting the industry's view of weight-loss drugs as a substantial profit driver for the future.

Investor enthusiasm for GLP-1 weight-loss drugs is palpable, significantly boosting the share prices of Novo Nordisk and Eli Lilly. A recent PwC report, however, underscores the increasing competition in this space. Despite the pharmaceutical sector's overall underperformance compared to the S&P 500 over the past year, companies with GLP-1 drugs in development are being rewarded by the market.

Amgen exemplifies this trend. Following an update on its obesity drug, the company's share price surged, prompting Barclays to upgrade its rating from 'underweight' to 'equal-weight' and raise its price target to $300. This positive outlook was echoed by UBS, Deutsche Bank, and BMO, although RBC adjusted its target to $328.

In summary, the GLP-1 weight-loss drug market is set to drive significant changes in the pharmaceutical industry. With high potential returns and increasing competition, companies are strategically positioning themselves to lead this emerging market, highlighting the transformative impact these drugs are expected to have in the coming years.

Challenges with Manufacturing and Supply of Obesity Drugs

High Demand and Shortages:

The surging demand for obesity drugs like Novo Nordisk’s Wegovy and Ozempic (semaglutide) and Eli Lilly’s Mounjaro (tirzepatide) and Trulicity (dulaglutide) has led to significant shortages.

These shortages are reported by regulatory bodies such as the FDA, EMA, Australia's TGA, and Health Canada, which have advised against starting new patients on these medications due to the global shortfall.

Capacity and Production Issues:

-

Internal Manufacturing Capacity:

-

Novo Nordisk: Began 2023 with one contract manufacturing filling line for Wegovy, added a second in H1 2023, and plans a third by 2024. Building additional internal capacity will take years, not easing 2024 shortages.

-

Eli Lilly: Plans a $2.5 billion manufacturing site in Alzey, Germany, for its diabetes and obesity portfolio, expected to open in 2027. Additionally, a Mounjaro production facility in Kobe, Japan, is expected to open in 2025.

-

-

Contract Manufacturing Organizations (CMOs):

-

Catalent: Faced productivity challenges and higher-than-expected costs at its facilities in Bloomington, Indiana, and Brussels, Belgium, leading to significant delays. The Brussels plant received FDA Form 483 observations in 2021 and 2022, indicating non-compliance with Good Manufacturing Practices (GMP).

-

Thermo Fisher and PCI Pharma Services are also involved in Novo Nordisk’s supply chain for Wegovy.

-

Ypsomed: Agreed to manufacture GLP-1 autoinjectors for Novo Nordisk, expected to start deliveries in 2025.

-

-

New Investments:

-

Novo Nordisk: Announced a $2.2 billion investment in Clondalkin, Ireland, to expand Ozempic and Wegovy production, expected to be operational by 2026.

-

Eli Lilly: Hired CordenPharma in Germany to produce the active ingredient for Mounjaro.

-

Regional Impacts:

-

United States: Sales of Wegovy grew by 467% in the first nine months of 2023, but supply constraints persist. The Ozempic shortage is expected to continue into early 2024.

-

Europe: Countries like Germany, the UK, France, Italy, Spain, and others face similar shortages.

-

Japan: Eli Lilly’s subsidiary announced plans for a Mounjaro production facility in Kobe, expected to open in 2025.

-

Australia and Canada: Health authorities have advised against starting new patients on these drugs due to shortages.

Market and Financial Impact:

-

The anti-obesity medicines market is projected to grow to $30 billion by 2030 across the seven major markets (US, France, Germany, Italy, Spain, UK, and Japan).

-

Combined sales of Wegovy, Ozempic, and Mounjaro in 2022 were $9.8 billion. Mounjaro is forecasted to surpass Ozempic’s sales, reaching $27 billion by 2029.

-

Novo Nordisk and Eli Lilly are focusing on increasing manufacturing capacities through significant investments, but short-term supply issues remain a challenge.

Reliance on CMOs:

-

Less-popular obesity treatments and other large CMOs like Jubilant HollisterStier LLC, Recipharm AB, and Catalent Inc. are heavily relied upon to meet the production demands.

-

These organizations face similar challenges in scaling up production to meet the unprecedented demand for obesity biologics.

Here is our data for the leading drug candidates in various stages of development: Excel table.