Verdiva Bio Launches With $411M to Propel Weekly-Dosed GLP-1 Obesity Drug

Verdiva Bio has launched with $411 million in Series A financing, reportedly one of the largest early-stage funding rounds for a U.K.-based biotech. The financing was co-led by Forbion and General Atlantic, with additional contributions from RA Capital Management, OrbiMed, Logos Capital, Lilly Asia Ventures, and LYFE Capital.

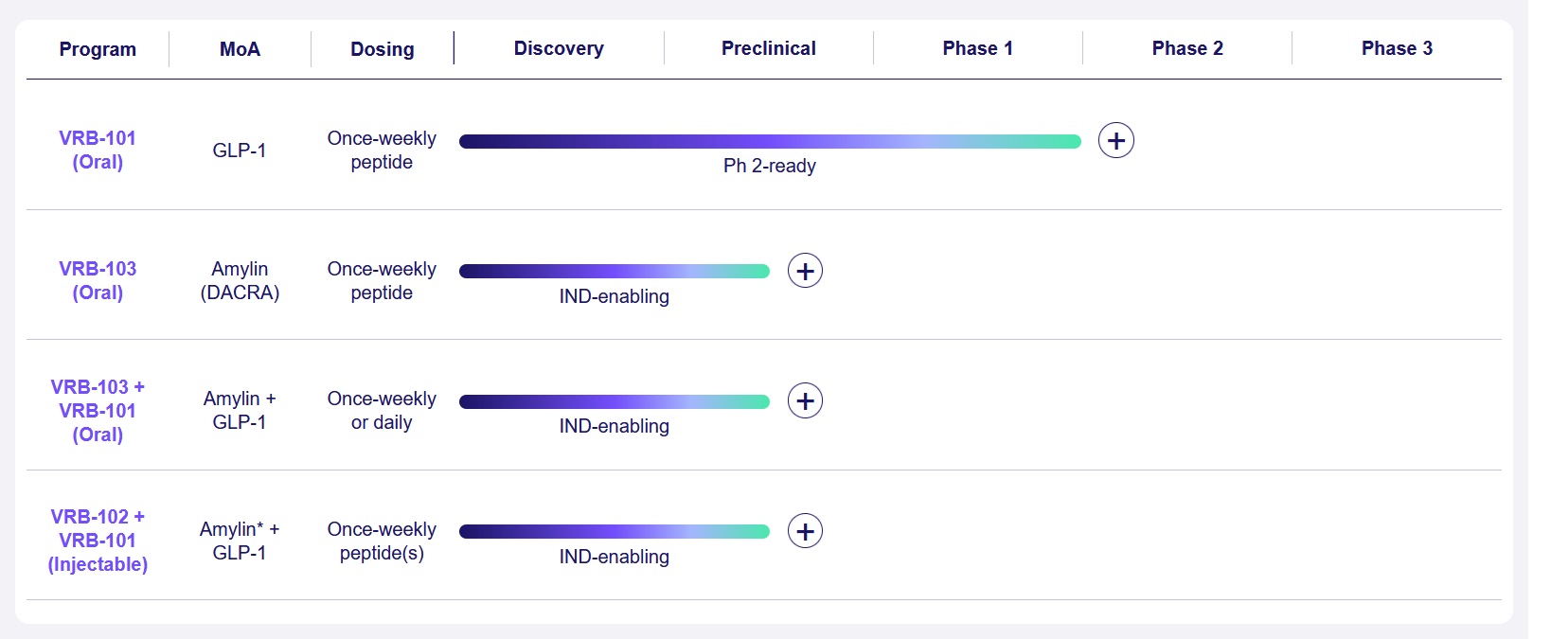

The company plans to use the funding to develop a portfolio of therapies for obesity and cardiometabolic disorders. The pipeline includes a once-weekly oral GLP-1 receptor agonist for weight loss and maintenance, acquired from Sciwind Biosciences. Unlike most oral GLP-1 candidates, which require daily dosing, Verdiva’s candidate is designed for weekly administration.

In addition to the GLP-1 program, Verdiva is advancing a once-weekly oral amylin agonist and a long-acting subcutaneous amylin agonist. These programs will be evaluated as standalone treatments and in combination, including a co-formulated tablet of the oral GLP-1 and amylin agonists.

Verdiva's current pipeline; Credit: Verdiva Bio

While most of the funding will support clinical development, Verdiva plans to allocate a portion to explore additional assets. CEO Khurem Farooq stated the company’s focus on building a cardiometabolic portfolio over the long term, with a commitment to advancing therapies that meet high clinical standards.

See also: A Booming Anti-Obesity Drug Discovery Landscape at a Glance (With Challenges)

Verdiva’s leadership team includes several members with experience at Aiolos Bio, which was acquired by GSK in 2024, shortly after its launch. Farooq, however, noted that Verdiva’s primary goal is not to position itself for acquisition but to remain focused on its independent growth.

The company is also considering options for additional funding in the future, including a potential IPO, as it prepares for the significant costs associated with phase 3 clinical trials. Farooq remarked that all funding strategies remain on the table as the company scales its operations.

Cover image: Verdiva Bio

Topic: Biotech Ventures