Singapore’s Nanyang Biologics Plans to Go Public on Nasdaq in US $1.5 Billion SPAC Deal

Singapore’s Nanyang Biologics (NYB), a company working at the intersection of biodiversity and artificial intelligence, is preparing to list on Nasdaq through a US$ 1.5 billion business combination with RF Acquisition Corp II, a U.S. special purpose acquisition company.

The deal, expected to close in the first half of 2026, would give NYB public market access while keeping its original backer, Hong Kong–listed The9 Limited, as a major shareholder.

Unlike many drug discovery firms that rely on synthetic chemical libraries, NYB is building one of the world’s largest collections of molecules from natural sources—plants, fungi, and microbes. These compounds are then screened using its proprietary AI platform, DTIGN (Drug-Target Interaction Graph Neural Network), which applies graph neural networks and protein language models to predict how molecules interact with disease targets. Early results suggest the system identifies promising candidates more efficiently than conventional docking methods (with an average improvement of 27.03%).

To ensure predictions hold up, NYB runs a full cycle of laboratory validation—ranging from mechanism-of-action studies to pharmacokinetics and toxicity testing—before advancing compounds toward the clinic. Its lead drug candidate, NB-A002, targets ILF2, a protein long viewed as undruggable, and is aimed at cancers caused by DNA damage repair deficiencies and resistance to existing therapies.

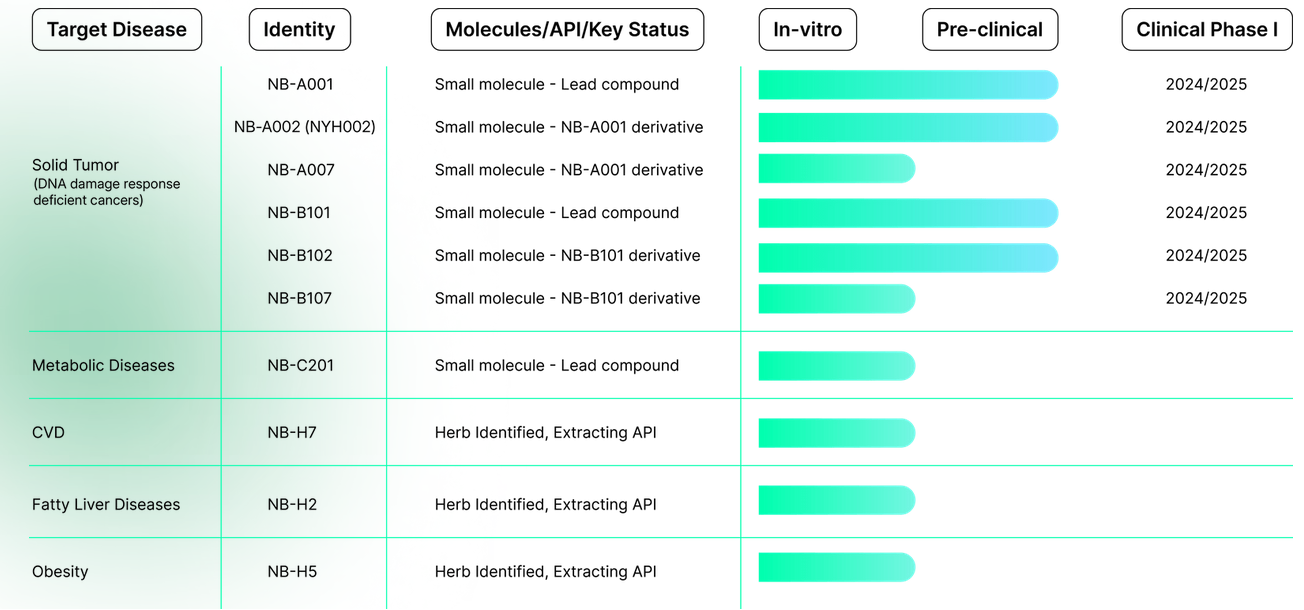

Nanyang Biologics' current drug development pipeline

The company has also secured collaborations with Nvidia, Hewlett Packard Enterprise, and Equinix to provide the computing power and secure infrastructure needed to scale AI-driven discovery.

We track developments like this weekly in Where Tech Meets Bio—our newsletter on startups, platforms, and deals at the intersection of biotech and digital.

Topic: Biotech Ventures