Insilico Medicine and Servier Enter up to $888M Oncology R&D Deal

Shortly after raising more than $290 million in its 2025 Hong Kong listing—one of the region’s largest biotech and AI IPOs of the year—Insilico Medicine entered a multi-year oncology R&D agreement with Servier, carrying a stated potential value of up to $888 million.

Servier is an independent French pharmaceutical group founded in 1954 by Jacques Servier and now headquartered in Suresnes, France, operating in around 150 countries. Governed by the non-profit Fondation Internationale de Recherche Servier (FIRS), the company focuses its R&D on oncology, cardiometabolism, venous diseases, and neurology.

The arrangement gives Servier access to Insilico’s AI-based discovery stack while committing both companies to shared research costs and a handoff structure in which Servier advances selected candidates into clinical development and commercialization. The deal adds to a growing set of alliances, including a recent $100 million Eli Lilly drug R&D and licensing deal in November 2025 that grew out of a 2023 software licensing agreement.

The collaboration with Servier centers on applying Insilico’s generative and predictive platform, Pharma.AI, to identify small-molecule oncology candidates that meet predefined criteria. Insilico is set to receive up to 32 million dollars in upfront and near-term R&D payments, with later milestones tied to progression and commercialization. Servier will assume responsibility for clinical studies, regulatory work and global market activities once candidates transition out of discovery.

Pharma.AI is structured as a set of interoperable modules for model-guided drug discovery, spanning target and disease modeling, generative chemistry, and automated experimental workflows built on foundation models trained across chemical, biological and clinical datasets. It can be used as discrete components or as an end-to-end stack covering early hypothesis generation through preclinical design and scenario prediction, and it is also applied by partners in areas outside human therapeutics.

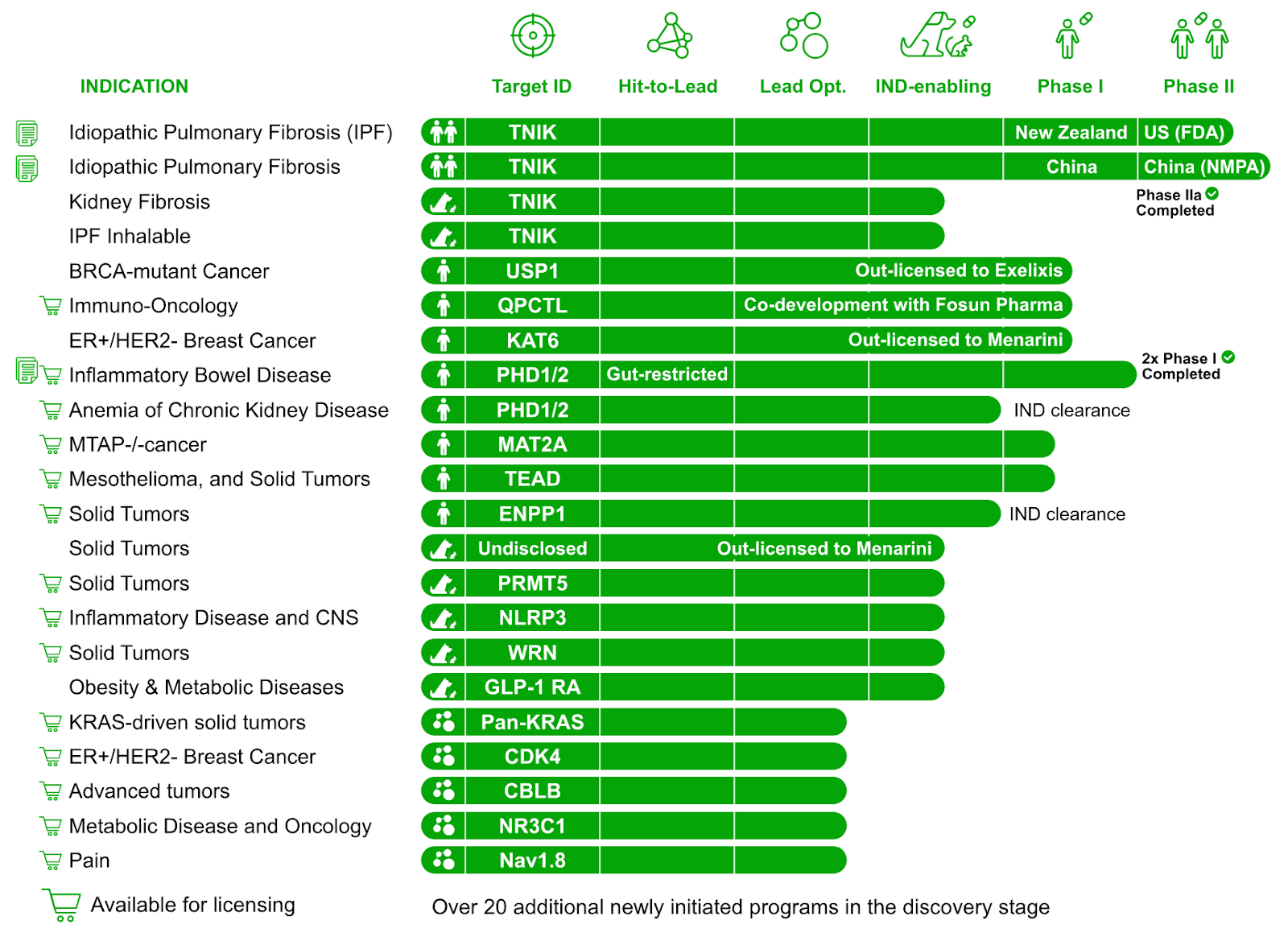

Insilico Medicine’s pipeline includes 40+ programs, with 24 preclinical candidates nominated since 2021 and 10+ IND-approved assets, all discovered using its Pharma.AI platform.

The agreement follows Insilico’s expansion of its AI-generated pipeline—24 preclinical candidates nominated since 2021 with an average reported time to PCC of approximately 13 months compared to traditional timelines of 2.5 to 4 years. Its internal oncology portfolio includes pan-TEAD and MAT2A inhibitors now in Phase I, along with several partnered programs that have also reached first-in-human studies.

Rentosertib, Insilico’s anti-fibrotic candidate, recently completed a Phase 2a trial with results published in Nature Medicine, and its gut-restricted PHD1/2 inhibitor for IBD, ISM5411, has advanced through Phase I. The company also recently disclosed eight AI-designed oral cardiometabolic programs across GLP-1R, NLRP3, and NR3C1 targets.

Cover image: Servier Research Institute in Gif-sur-Yvette, France; credit: Wilmotte & Associés

Topic: Biotech Ventures