BenchSci

2015

Technologies

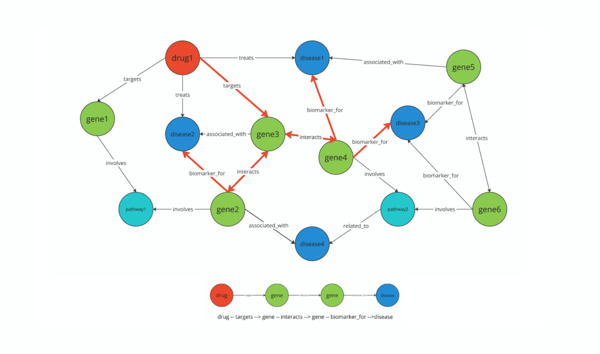

AI Companies (Drug Discovery)BenchSci is a Toronto-based software company advancing biomedical research through a hybrid AI framework that combines generative models with structured knowledge representation. Its core technology translates unstructured scientific data—spanning figures, full-text publications, reagent metadata, and ontologies—into a machine-readable format, enabling researchers to query complex biological relationships with traceability and precision. The platform supports real-time exploration of experimental evidence, integrating symbolic reasoning to resolve terminology mismatches, highlight protocol nuances, and synthesize findings across diverse data types.

Founded in 2015, BenchSci is backed by F-Prime, Gradient Ventures (Google), Inovia Capital, and TCV. Its technology is adopted by 16 of the top 20 pharmaceutical companies and over 4,300 research institutions worldwide. The company operates on a remote-first model and has been recognized by Deloitte Tech Fast 50, CIX Top 10 Growth, and Great Place to Work.

reagent selection protein target AI-assisted selection antibody selection